Hilgert calls the discount "overly punitive," and says it's the result of a lack of buy-in to the company's five-year plan and its highly levered balance sheet. Nevertheless, the market continues to discount the automaker. "We believe the outperformance relative to market expectations was due to higher-than-anticipated margin expansion in North America, being in the black in South America, and continued progress on European recovery," says senior analyst Richard Hilgert. Earnings per share were well above consensus.

Shares carry a fair value estimate of $47.ĭespite headwinds, Fiat Chrysler posted pretty impressive numbers this past quarter. "We still think HollyFrontier presents one of the more compelling opportunities in the sector currently, given the poor performance of its shares of late relative to its long-term outlook," says Good. In fact, the company earns a narrow economic moat. And although HollyFrontier is a relatively small player, its refineries are competitively well positioned. He also expects blending margins to improve going forward due to higher gasoline prices and margins. Good notes that HollyFrontier remains on track with its business improvement plan to deliver incremental EBITDA of $700 million by 2018. "While a poor quarter and below expectations, we see most of that weakness as attributable to seasonal factors and continue to expect gasoline margins to strengthen in the coming months as they have since the end of the first quarter," says analyst Allen Good. To make matters worse, higher ethanol blending costs nicked margins and earnings, too. Earnings tumbled from the year before as gasoline margins weakened substantially during the quarter. Last quarter was not kind to the refiner, which owns and operates five petroleum refineries serving the Rockies, midcontinent, and Southwest. Katz pegs the stock with a $70 fair value estimate. “Even in a more competitive retail environment, we expect the company to be able to achieve low-double-digit ROICs," says Katz. She projects total sales growth in the low-single-digits over the medium term, low-single-digit same-store sales (just below 2% on average), and unit location growth of about 20 stores per year.

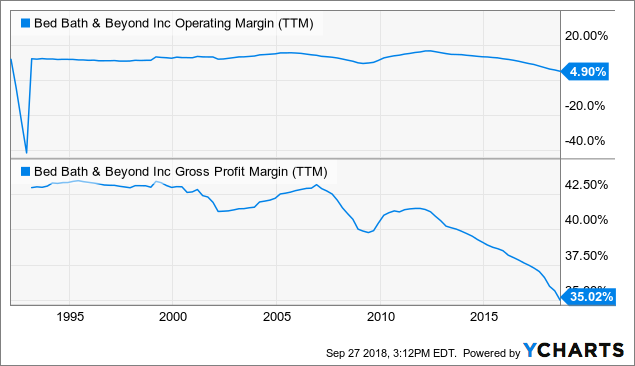

International expansion and increased ominchannel offerings, such as buy online/pick up in store, will support growth, too. Moreover, Katz expects the business to continue to benefit from rising housing market prices and stable turnover. "Even with industry headwinds persisting throughout our explicit forecast, Bed Bath still has tremendous cash flow potential," says analyst Jaime Katz.įor starters, registries in bridal, baby, and gift provide a steady stream of customers. Not surprisingly, the company's shares are undervalued by most measures today. That will lead to some operating margin compression going forward. In an effort to maintain its competitive position, the company expects to increase capital spending. Like many retailers, no-moat Bed Bath & Beyond faces an uphill battle against online competitors.

0 kommentar(er)

0 kommentar(er)